When Payday Loans Are Not Good

A wide range of consumers look to payday loans as the ultimate solution to their financial problems. Yet there are also times when a pay day loan is not the best option for you to pursue. It is very important to ensure that you take the time to really analyze your finances before you start looking for a payday loan to be sure that you are actually in a good position to apply for a payday loan. Of course, almost anyone can be approved for a loan, but that certainly does not mean that it is a good option for you. Deciding if a payday loan is a good idea for you is a decision that needs to be made based upon your own personal finances. If you are looking at your finances and realize immediately that there is no way you can repay the money quickly then you are likely going to realize that a payday loan is not the best option for you. Additionally, if you are thinking about merely paying back a tiny bit of the loan at a time then a payday loan is not a good option for you.

For borrowers who do not have a checking account there is typically no way to get a payday loan. It is also a requirement to get a payday loan that you be at least 18 years old. Other requirements that are common are the need for a verifiable income and also the need to have a verifiable residence that can be given in your application. If you do not have a checking account, have no verifiable income and do not have a verifiable address then you are going to be facing great difficulty in obtaining a payday loan. One problem that is unable to be overcome with payday loans is there is no way to use a co-signor. While typical loans will allow you to ask for a co-signor to assist you in securing the loan, a payday loan is obtained solely based upon your own qualification and will not permit the use of a co-signor. This can means if you are not approved for a payday loan that you are looking at an almost impossible task of actually being approved regardless.

As long as you are aware of the reasons that can harm your chances of being a suitable borrower for a payday loan you can generally take some steps to improve your chances of success. However, being aware that not everyone is a suitable candidate for a payday loan is important. Much as you may want and need a payday loan there is no guarantee that you will be approved. If you know for sure that a payday loan is not a suitable option for you, there is no need to waste your time by applying. Looking for a payday loan that is not a suitable financial tool for your needs is a huge waste of your time. It is a much better idea to instead look for a much more appropriate option that will fit your needs and your budget. Just take comfort in realizing that you are at least aware of your financial situation and are aware of what you can and cannot manage.…

Posted by Richard Flores on 2020-02-27

Bad Credit Payday Loans Are Essential

For those consumers who have bad credit there are few things worse than finding out that you are completely on your own when it comes to ensuring that you are able to pay your bills. The bad news about having bad credit is the fact that your options for getting money you need to pay all of your bills is severely limited. Yet at the same time, there are options and choices that you have which will work with you to ensure you can still get the money you need to pay your bills.

For those consumers who have bad credit there are few things worse than finding out that you are completely on your own when it comes to ensuring that you are able to pay your bills. The bad news about having bad credit is the fact that your options for getting money you need to pay all of your bills is severely limited. Yet at the same time, there are options and choices that you have which will work with you to ensure you can still get the money you need to pay your bills.

Generally speaking, those with bad credit have very few options available to them. One of the last remaining options that is available is a no credit check payday loan. While it may seem quite unfair that a payday loan is the only option available it does at least provide those with bad credit an option that can help them. The worse part comes when someone is unable to even qualify for a payday loan. The good news is the fact that very few people with bad credit are turned down for a payday loan.

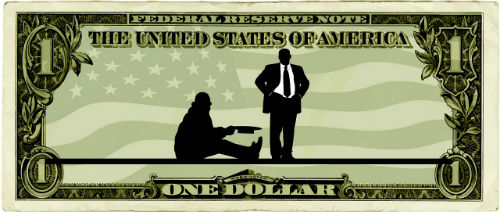

The majority of people with bad credit are not bad people themselves, rather they have typically been given a very harsh time in life and merely need a bit of assistance to get back on track. Yet a single visit to a traditional bank can leave someone with bad credit feeling as if they are not worth the ground they walk on. But what else can someone do when they have bad credit? It is not easy to always make your budget fit your needs.

The majority of consumers tend to have more bills than they have money coming in, which can be a huge problem. The number of consumers who are unable to pay their bills continues to grow, yet the number of people who are declined after they apply for a traditional loan continues to skyrocket as well. Choosing to apply for a payday loan is often the only option that people have because it is the only way they are able to obtain the money they need.

Consider what happens to someone who has bad credit and is barely surviving when they suddenly are faced with a financial emergency. They usually have the disaster of deciding which bill is more important and working to ensure that they pay as many as possible. A payday loan for those with bad credit means that help is still just around the corner. Working with the payday loan lender they are able to still get the short-term loan they need to pay their bills, without having to struggle to determine which bills get paid, and which are merely shoved to the side.

Just because someone has bad credit does not mean that they do not have any financial problems, in fact those with bad credit usually have a much harder time trying to pay all of their bills. This means that generally speaking, someone with bad credit will have a much harder time paying their bills, which means that a online payday loans can be a huge help for someone who is struggling to ensure that their bills are paid and they manage their finances responsibly.…

Posted by Richard Flores on 2020-02-15

Payday Loan Advance Alternatives

The alternatives to a payday loan are quite extensive, the choices that you have may not always be the perfect choice, but they are available. However, at times when you need money fast it is a case of choosing the best option for your particular needs that will get you the money you need the fastest. What works best for you might not be the best for someone else, and this is ok, it is merely about making sure you get the money you need. However, for those who are looking for fast money, what other options are there really?

Your first choice is of course a good traditional bank loan. This is the type of loan that most people think of when they first start thinking about a loan. However, if you have had credit problems, money problems, a new job, a recent move, or any other one of a huge list of potential problems you are looking at being denied quickly. However, while this can provide the cheapest interest rates for borrowers it can also take a large chunk of time to deal with applying for the loan.

Another alternative for those who own their home is a home equity loan. This is generally not appropriate if you are just needing a small amount of money. Plus, many times home equity loans require that you spend a certain amount in fees and other charges associated with getting the loan. This can make it widely out of reach for those who either do not own their home, need only a small amount of money, or have no money to spend on the fees associated with the home equity loan.

Title loans are also possible for many consumers. This will involve a person giving the title to their vehicle in exchange for a small loan. The loan is typically based upon a percentage of the value for the vehicle as well. This means that someone who has a very basic car with a lot of miles on the vehicle will not be able to obtain as much money as those who have a very new vehicle with very few miles. This can create a problem for consumers who have only a basic car but still need several hundreds of dollars. Additionally, many consumers are not comfortable with the idea of putting their vehicle at risk in the event that they are unable to pay off the loan.

The final popular alternative is a pawnshop loan. This type of loan involves taking an item that you own that is worth value and giving it to a business called a pawnshop. They then hold onto your item as collateral and give you a loan. Typically, it is very difficult to get enough money in a pawnshop to really handle any expenses that you may have which in addition to the very high interest rates make them a poor choice for most people. Another common problem is the fact that most people are not comfortable putting up their personal items for collateral.

Online payday loans will provide the money that people need without require them to put up the title to their car, without requiring them to place personal items up for collateral and without forcing them to obtain a new mortgage on their home that they may not be able to afford. It is by far one of the simplest methods that consumers have to obtain the cash they need very quickly and at affordable rates.…

Posted by Richard Flores on 2020-02-04